When it comes to certain things in life, like where you get your daily cup of coffee or where you shop for clothes, you can certainly be frugal in order to try to save as much money as possible. But when it comes to insurance, you shouldn’t take the cheap way out all the time. Sure, you can search for different plans from various insurance providers to find the best rate for your budget, but you shouldn’t skimp on the coverage that you really need just to save a buck.

Why is insurance one thing that you shouldn’t be overly frugal about? Continue reading to learn about a few of the main types of insurance and why they’re necessary and worth the cost. Health Insurance

Health Insurance

One of the first types of insurance that everyone thinks of is health insurance, and this is also one of the most important ones. Regardless of your age, having a solid and reliable health insurance plan in place will give you the peace of mind of knowing that your medical expenses will be covered in the event that you become ill or injured.

Whether you are young, healthy, and single, you have a family with children, or you are older, health insurance is absolutely necessary. And you can find the plan that’s right for you with the most affordable monthly premium, deductible, and copay. Just make sure you find a plan that your doctor accepts.

Auto Insurance

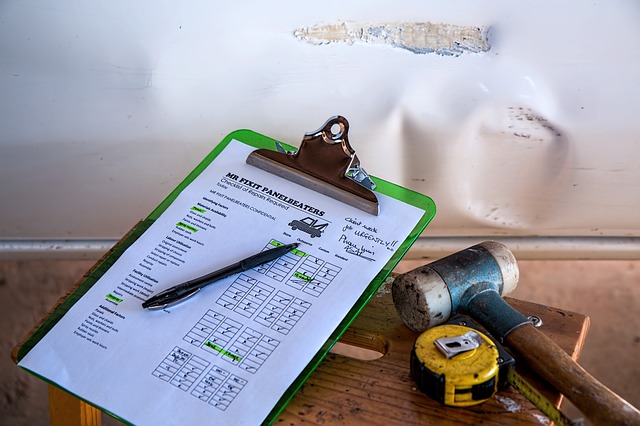

Another major form of insurance that you absolutely need before you head out onto the road as a driver is auto insurance. Again, there are many providers to choose from and a host of different plans with varying premiums, deductibles, and copays to fit every budget, so there’s no excuse to not have this coverage in place.

A comprehensive auto insurance policy will cover you in the event that you’re involved in an accident, especially if it was your fault and the person you injured requires expensive medical care and car repairs. The right policy will also cover you or a passenger if you’re hurt in an accident, and can even cover acts of vandalism against your vehicle or other accidental collisions that might occur. As with all other forms of insurance, this is definitely one type that’s more than worth the money because of just how expensive the costs are when you’re involved in a crash.

Homeowner’s or Renter’s Insurance

Homeowner’s or Renter’s Insurance

If you own a home, you definitely need a good homeowner’s insurance plan in place to cover you in the event that your home is burglarized or you incur any damage to your property as a result of a natural disaster. Depending upon where you live, you may need extra policies for things like floods, and you definitely don’t want to skimp on this vital coverage.

Even if you rent, you should have a good renter’s insurance policy in place to cover you in the event of theft or other damages to the property. Renter’s insurance can be surprisingly affordable, but it will certainly save you money if you ever find yourself in need of its support.

One Day Insurance

If you’re planning on hosting a large event for just a single day, opt for one day event insurance, as it will cover the company or individual who’s hosting the event. Whether you’re putting a concert together or you’re planning a big wedding celebration, there are many things that can go wrong when you have that many people in one place with so many staff members and workers, as well as expensive equipment and facilities too.

The best one day event insurance policy will be one that will not only be affordable, but will also cover damages to all types of property throughout the event, including equipment, clothing, cars, etc. You should also have a plan that will cover you in case someone gets hurt or even dies during the event. And you want a plan that will also cover liability in case someone tries to sue you.

The premium that you will pay for one day insurance will depend upon things like how many people are attending the event, the amount of risk involved, your previous history as an event promoter, and the total coverage you need.

Ultimately, with the right insurance plans in place, you can rest assured that you will be covered and your assets will be protected in the event of any kind of lawsuit or disaster at home, on the road, or at work.